I only have a handful of business clients, and most of them I been doing work for since a long time, and we built a relationship.

Earlier this year I was reached by a business owner who owns a construction business, small one, on my Facebook page. He wanted me to set up some automation to backup Google Drive, which he already had in place by another tech (which in his words "wouldn't respond to his calls"). He also mentioned that in the future he wanted to set up a structured file sharing method, so he can share files securely with his employees. He also wanted to buy a domain for email purposes, etc.... He said that the backups were the most important thing.

So I've met him at his office, discussed these things and I told him that I can guide him through all this and even set things up for him. Gave him a quote for the backups and he agreed. Prepared the script offsite, and implemented it onsite. He wasn't there, sent him an invoice, and he paid immediately.

A few weeks later he asked me to proceed with the domain etc... I sent him a detailed quote, that included a quote for me to consult him on what to do, and a quote for me to also implement the solution. He agreed to proceed with implementing the solution, together with the domain purchase, hosting, M365, and all the good stuff. I did this work remotely, he paid for the third parties and I sent him an invoice for my work.

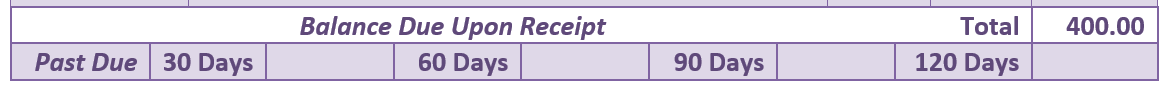

More than a month later and I am still waiting the payment. I messaged him around 3 weeks after the job, and he said that he missed my email and that he is very sorry. I re-sent the email and the invoice by WhatsApp. WhatsApp messages do not show as read, but I know he opened both the original email and the second email, as I use MailSpring and it shows when an email is opened. Today, 6 weeks later, I sent him another message reminding him about the pending invoice and received no feedback.

So at this point I have a feeling that this customer hops from one person to another, and doesn't pay them. The only thing I can think of is to call him and keep sending him reminders by email and WhatsApp. But I also want to find a way to not have to deal with this again in the future. I can't think of anything more other than starting to charge a percentage of the cost in advance (naturally, if I charge by the hour it's going to be an approximate cost).

Anyone here had to deal with such situations and have any tips for me? I am trying to attract business customers, but this is discouraging.

Earlier this year I was reached by a business owner who owns a construction business, small one, on my Facebook page. He wanted me to set up some automation to backup Google Drive, which he already had in place by another tech (which in his words "wouldn't respond to his calls"). He also mentioned that in the future he wanted to set up a structured file sharing method, so he can share files securely with his employees. He also wanted to buy a domain for email purposes, etc.... He said that the backups were the most important thing.

So I've met him at his office, discussed these things and I told him that I can guide him through all this and even set things up for him. Gave him a quote for the backups and he agreed. Prepared the script offsite, and implemented it onsite. He wasn't there, sent him an invoice, and he paid immediately.

A few weeks later he asked me to proceed with the domain etc... I sent him a detailed quote, that included a quote for me to consult him on what to do, and a quote for me to also implement the solution. He agreed to proceed with implementing the solution, together with the domain purchase, hosting, M365, and all the good stuff. I did this work remotely, he paid for the third parties and I sent him an invoice for my work.

More than a month later and I am still waiting the payment. I messaged him around 3 weeks after the job, and he said that he missed my email and that he is very sorry. I re-sent the email and the invoice by WhatsApp. WhatsApp messages do not show as read, but I know he opened both the original email and the second email, as I use MailSpring and it shows when an email is opened. Today, 6 weeks later, I sent him another message reminding him about the pending invoice and received no feedback.

So at this point I have a feeling that this customer hops from one person to another, and doesn't pay them. The only thing I can think of is to call him and keep sending him reminders by email and WhatsApp. But I also want to find a way to not have to deal with this again in the future. I can't think of anything more other than starting to charge a percentage of the cost in advance (naturally, if I charge by the hour it's going to be an approximate cost).

Anyone here had to deal with such situations and have any tips for me? I am trying to attract business customers, but this is discouraging.