thecomputerguy

Well-Known Member

- Reaction score

- 1,326

I'm not sure if this is even I should be responsible for addressing as I have really no experience or authority regarding Identity theft.

A REALLY good client of mine who is on a big-time MSP monthly bill has called me to have conversations about how he keeps getting hit with fraud. He's had to replace his cards a couple of times, he's been notified of attempted account openings under his name. I do know that his email system at O365 is fine (MFA), and I regularly check sign in logs and see nothing to be worried about.

I just told him all I really know about it is that if your vital information gets leaked by some third party and they get ahold of your SSN, DoB & Address, that's about all they need to commit fraud.

He asked about monitoring services but I personally don't have a lot of experience in that so I couldn't give him any advice there.

He went ahead and signed up for Norton LifeLock and now he's calling me again because he is getting Alerts every week from Norton about attempted account openings at Payday lenders and Cell phone stores.

The last issue to happen was they got a legitimate bill from one of their legitimate vendors for something they didn't buy. Thankfully it was a small item but it made no sense. The item they purchased was basically like the Amazon Prime version of this vendor. It qualified my client for free shipping for the year. What's the point of this type of fraud? They are attempting to upgrade my clients business account for them?

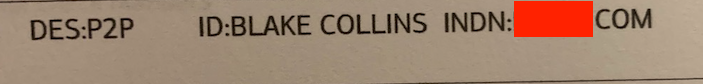

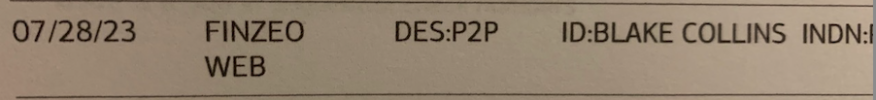

My client was about to pay by check when the realized that no one meant to purchase this. When we look it up online at the vendor it shows that it was a WEB purchase, which is NOT how this client normally purchases. It shows it was purchased by someone who created an email to impersonate my client. Instead of like johnjamesdoe@contoso.com they created a johnjamesdoe@gmail.com. It had a phone number listed and when that number is called a guy named "Steve" answered the phone, spoke perfect English and he had no idea what the heck was going on either other than he himself had ALSO been receiving calls from payday lenders looking to approve loans for my client or John James Doe.

Steve was also very confused and didn't know how to stop these calls.

I haven't had a chance to call the vendor and ask them how in the hell they approved a purchase when it didn't come from my client, it wasn't how they normally ordered, it didn't use my clients email, it didn't use my clients phone number but yet they still got invoiced for it.

The vendor is a reputable Fortune 500 company so I doubt they are in the scamming business - https://www.grainger.com/

What if anything is my responsibility here?

A REALLY good client of mine who is on a big-time MSP monthly bill has called me to have conversations about how he keeps getting hit with fraud. He's had to replace his cards a couple of times, he's been notified of attempted account openings under his name. I do know that his email system at O365 is fine (MFA), and I regularly check sign in logs and see nothing to be worried about.

I just told him all I really know about it is that if your vital information gets leaked by some third party and they get ahold of your SSN, DoB & Address, that's about all they need to commit fraud.

He asked about monitoring services but I personally don't have a lot of experience in that so I couldn't give him any advice there.

He went ahead and signed up for Norton LifeLock and now he's calling me again because he is getting Alerts every week from Norton about attempted account openings at Payday lenders and Cell phone stores.

The last issue to happen was they got a legitimate bill from one of their legitimate vendors for something they didn't buy. Thankfully it was a small item but it made no sense. The item they purchased was basically like the Amazon Prime version of this vendor. It qualified my client for free shipping for the year. What's the point of this type of fraud? They are attempting to upgrade my clients business account for them?

My client was about to pay by check when the realized that no one meant to purchase this. When we look it up online at the vendor it shows that it was a WEB purchase, which is NOT how this client normally purchases. It shows it was purchased by someone who created an email to impersonate my client. Instead of like johnjamesdoe@contoso.com they created a johnjamesdoe@gmail.com. It had a phone number listed and when that number is called a guy named "Steve" answered the phone, spoke perfect English and he had no idea what the heck was going on either other than he himself had ALSO been receiving calls from payday lenders looking to approve loans for my client or John James Doe.

Steve was also very confused and didn't know how to stop these calls.

I haven't had a chance to call the vendor and ask them how in the hell they approved a purchase when it didn't come from my client, it wasn't how they normally ordered, it didn't use my clients email, it didn't use my clients phone number but yet they still got invoiced for it.

The vendor is a reputable Fortune 500 company so I doubt they are in the scamming business - https://www.grainger.com/

What if anything is my responsibility here?